Will Amazon Pharmacy Disrupt Rx?

Healthcare

5 Myths and What Amazon Pharmacy Will Mean For Your Wallet

Let’s cut through all the confusing pharmacy jargon and get to the big idea-Amazon is not doing anything fundamentally different in the prescription drug space…yet.

In November 2020, Amazon Pharmacy entered the world of prescription drugs-this is a market sized in excess of $500 billion in the United States. The Amazon Pharmacy benefit is being offered to all 126 million Amazon Prime members, in addition to their many other member perks such as free 2-day shipping and online streaming of Amazon Video.

The benefit of Amazon Pharmacy to Amazon Prime members is the promise of 80% off generic drugs, 40% off brand name medications, as well as a savings card that can be used at up to 50,000 brick and mortar pharmacies including CVS, Walgreens and Walmart. You can compare prices both with and without insurance at checkout. In some cases, Amazon Pharmacy could make your out of pocket cost for a prescription lower than when using insurance. Amazon says it works with most insurance plans.

Sounds pretty amazing, right? There’s a big caveat here: this is not fundamentally different from what some other players are doing in the prescription drug space. In fact, this model is exactly the same as what Good Rx does. What’s more, it is so similar to Good Rx that the two companies launched using the exact same partner to administer their prescription discount program-Inside Rx (Inside Rx is owned by Express Scripts, and is a subsidiary of Cigna’s Evernorth). Yes, hiding within Amazon Pharmacy are all the usual players to ensure Amazon can play the prescription drug game by the rules, be able to work with 3rd party payers and to keep prices competitive.

So let’s look at some assumptions which are actually myths about Amazon Pharmacy.

- Amazon’s dive into pharmacy has disrupted the prescription drug market

For now, Amazon has just “entered the ring,” and disruption has not happened yet. There is currently nothing they are doing that is fundamentally changing the prescription drug market other than accessing their 126 million Amazon Prime members and offering this option as an additional benefit. While what they are doing in the prescription drug space is not substantially different from other players in the market, the mere fact that Amazon is the leader in distribution logistics with an already impressive nationwide U.S. household brand saturation positions them to have a high potential to disrupt the prescription drug market in the future.

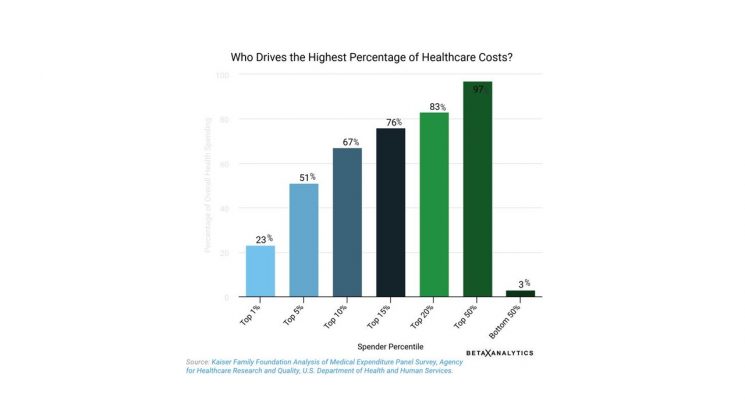

2. Amazon Pharmacy’s goal is to make prescriptions more affordable for uninsured Americans

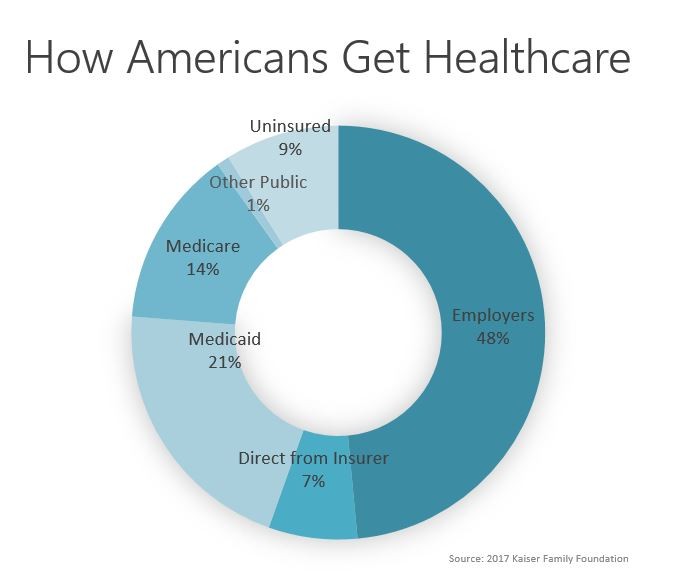

Unfortunately this is not the exact problem Amazon Pharmacy is solving right now. Keep in mind this benefit is only available to those who are paying $119/year for their Amazon Prime membership. To take this further, according to Ge Bai, Associate Professor at John Hopkins Bloomberg School of Public Health, the relatively small number of uninsured patients as a market do not have enough clout to be a viable business model for Amazon. Cash buyers make up less than 5% of the overall retail prescription spending. Amazon is targeting customers who have commercial prescription coverage (usually through employers) and people covered through Medicare-combined, these groups make up 79% of retail prescription drug spending. While not exclusively targeting the uninsured, Amazon Pharmacy is certainly providing a consumer-friendly option for cash buyers to buy prescription drugs.

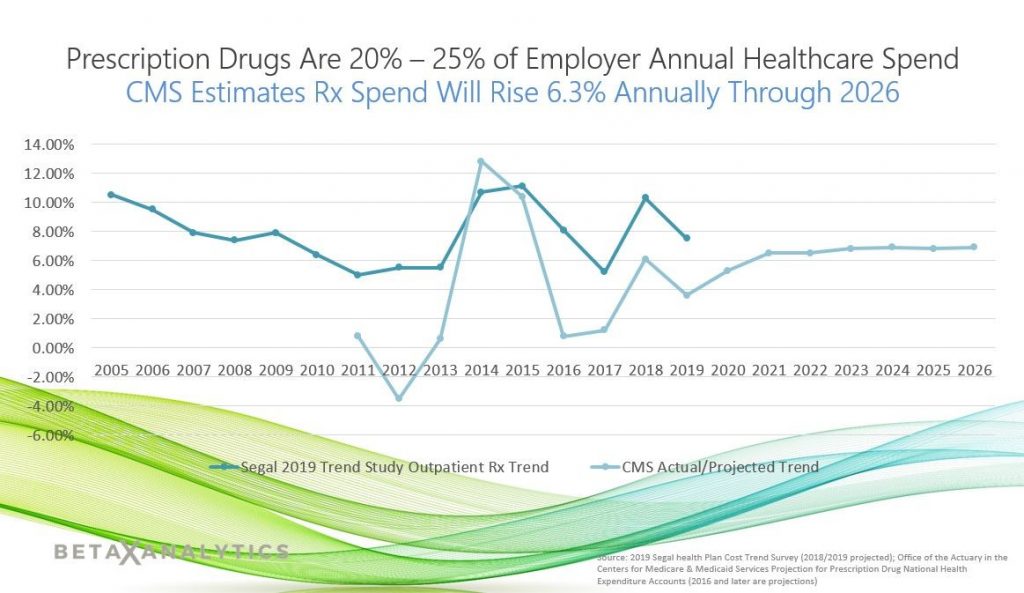

3. Amazon Pharmacy is going to fix out-of-control prescription drug prices in the U.S.

Not exactly. Amazon Prime members will be able to enjoy lower prices on some drugs, however these discounts are still covered by the same PBMs who are covering the very high cost of drugs in the first place. What Amazon Pharmacy is doing is offering value to their members through price transparency and making it easier for Prime members to price compare the cost of medications paying cash versus using their insurance coverage. They are offering convenience to Prime members with quick and reliable shipping, and perhaps more competitive prices on select drugs, but they are not currently tackling the underlying runaway drug pricing issue in the U.S..

4. Amazon Pharmacy’s prices will be the cheapest prescription prices available

This will not always be true. It appears that Amazon Pharmacy is aiming to make drug prices competitive for some popular drugs such as Humira, Metformin, and Januvia, however other medications could be more expensive than competitors. To illustrate this price variability, Dr. Eric Bricker has done a nice job illustrating price comparisons between Good Rx and Amazon Pharmacy. His analysis shows that Amazon and Good Rx prices vary by drug, and neither company could be blanket dubbed to always be “the cheapest option.”

5. Amazon Pharmacy will cut out Pharmacy Benefit Managers (PBMs) such as CVS Caremark, Express Scripts and Optum Rx

This is not the case. While Amazon Pharmacy is new on the prescription drug scene, they need to play by the same rules to navigate the complexity of the prescription drug market in the U.S.. Keep in mind Amazon Pharmacy is using Inside Rx to administer their prescription discounts; they are working within the PBM model, so they are not currently doing anything to drastically change the system people currently use to get their prescription drugs. And because the largest portion of prescription drug spending comes from commercial payers and Medicare, maintaining the ability to effectively deal with 3rd party payers is needed to enable people to access their coverage when they order medications from Amazon Pharmacy.

Amazon’s Challenge in Rx: Behavior Change

Amazon Pharmacy is looking to bring convenience and more transparent pricing to Amazon Prime users by offering free, 2-day delivery for medications at scale. It is useful to note here that there is one nut Amazon needs to crack to truly become disruptive in the prescription drug space- behavior change.

Mail order pharmacy, while long understood to be convenient and in some cases less expensive for some medications, in 2019 it made up roughly 5%of the prescription drug market. Even in light of the pandemic over the past year when people have limited their trips outside of their homes, it is still unknown whether the use of mail order prescriptions will see a sustained increase in the future.

What are the barriers to more Americans using mail order pharmacy? First mail order pharmacy does not fit in to “the way things have always been.” Right now, most doctors prescribe your medication and send it directly to your local retail pharmacy for same-day pickup. This is the default way many people are getting new prescription medications right now. Also, it is important to note the high proportion of people on Medicare who are using multiple prescription drugs on an ongoing basis. This population has had the lowest penetration by Amazon Prime, and may be less apt to seek alternate methods for getting prescriptions. An additional barrier is that people over age 65 may be less digitally savvy to go online to switch to mail order prescription fulfillment.

With Change Comes Opportunity

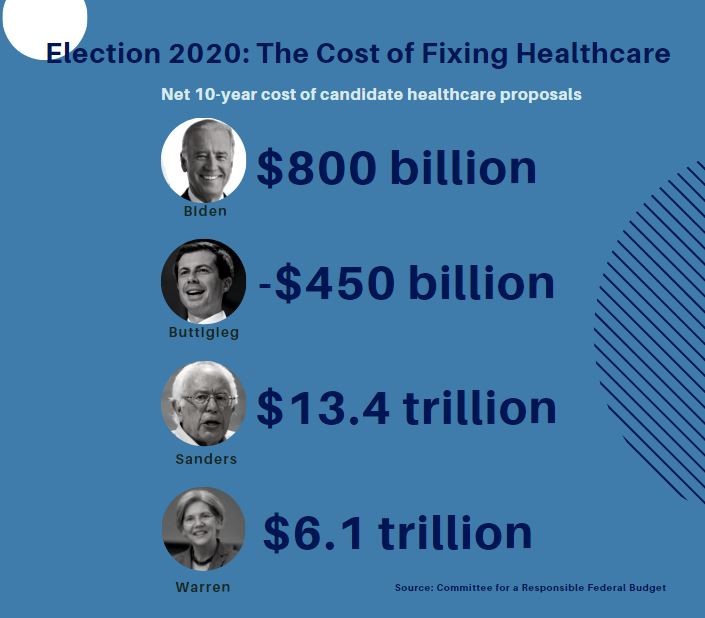

Before they are able to disrupt the prescription drug market in the United States, Amazon Pharmacy currently faces the difficult task of changing consumer behavior with respect to how people get their prescription drugs. However, looking beyond today and in to the future, there is new potential on the horizon. As American health care takes on a new trajectory under the Biden administration, Amazon Pharmacy could be poised to respond to the new opportunities that change and health care reform may bring.

* * *

Originally published at https://www.linkedin.com.