Employers Are Using an Innovative Way to Soften the Financial Burden of High Deductible Health Plans

Healthcare

As a healthcare data technology company, the most common question we hear from employers is, “how can we lower our healthcare spending?” The high cost of healthcare has a significant impact on employer expenses. The Milliman Medical Index projects that in 2018 the average premium for a family of four is $28,166. While the magnitude of health costs is a reality for our employer clients, finding an effective way to manage these high costs is often their first priority.

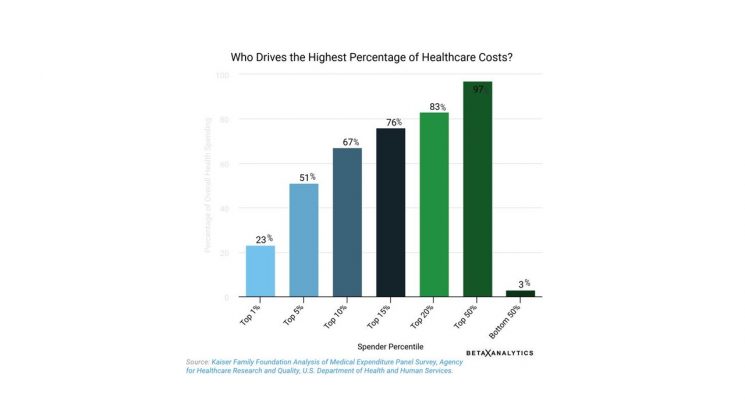

When we drill down into cost-drivers, we consistently see a startling theme across employers—that only 5% of people are driving 51% of healthcare spending. A very small group of people with chronic conditions (such as diabetes, rheumatoid arthritis, or cancer) are contributing to half of the total health spending. While this disproportionate spending is a reality within employer populations, according to the Kaiser Family Foundation Medical Expenditure Panel Survey, this also holds true for Americans as a whole.

As a way to manage the rising cost of healthcare, nearly 40% of adults are covered by what is known as a high-deductible health plan. Under this model, employees share in a greater share of their health expenses, responsible for on average $5,248 of out of pocket medical costs each year. The thinking behind this way of cost-sharing with employees is that when employees are responsible for paying a greater share of their health expenses, that they will become better healthcare consumers by shopping for the best prices and avoiding unnecessary procedures.

Unfortunately, in many of these cases the high out-of-pocket medical costs cause financial hardship on many people. A survey from the Kaiser Family Health Foundation found that 1/3 of adults have trouble paying their medical bills, and 73% have cut back on spending on food, clothing or basic household items to pay their medical bills. The Report on the Economic Well-Being of U.S. Households, an annual survey conducted by the Federal Reserve Board, found that 44 percent of adult Americans claim they would not have $400 in case of an emergency without turning to credit cards, family and friends, or selling their own possessions. When those who are financially strapped have mounting healthcare bills, the consequences can be personally devastating. A 2015 poll by the Robert Wood Johnson Foundation and the Harvard T.H. Chan School of Public Health found that 26 percent of those who took part in the survey claimed medical bills caused severe damage to their household’s financial wellbeing.

Because the impact of high healthcare deductibles causes such a financial hardship for individuals and their families, many recent studies have shown that this type of health plan causes individuals to delay necessary healthcare. Researchers from UC Berkeley and Harvard studied the results of a large employer’s choice to offer a high deductible plan over 2 years. Instead of finding evidence to support the theory that high-deductible plans make people take more charge of their health spending, they found no evidence to show that employees were comparing costs or cutting unnecessary services once they had a high healthcare deductible. They cut low-value health services at the same rate as they were cutting important medical services, causing the employer to question whether members were making the right choices for their long term health. Additional studies have found that the danger of high deductible health plans is that their members with the highest health risks have shown that they avoid necessary care and medications due to cost.

On the other side of the phenomenon that 5% of people drive 51% of health costs, we see another theme that is equally surprising—half of plan members contribute to only 3% of total health spending. That’s right—a large proportion of costs come from a small number of people, yet a large number of people contribute very little to overall costs. Why is this?

At BetaXAnalytics, when we look at employer utilization of health services we consistently find that between 10%-20% of members never see their doctor. These are the employees who either feel they simply “don’t have time” to see the doctor or “don’t have the money” to spend into their annual deductible. But it’s within this group of people who are not driving costs today where an employer’s greatest healthcare risks can lie.

The answer for employers? Make it as easy as possible for members to get the care they need. One effective way to ensure that people aren’t avoiding necessary care is to remove the traditional financial and convenience barriers that prevent employees from seeing the doctor. Hooray Health provides a template for employers to solve this problem. They afford first dollar coverage for preventative, basic and urgent care visits with $0 deductibles, and $25 copays for all in-network visits. Their innovative network consists of over 2,400 retail clinics and urgent care centers across the country with extended hours and no appointments necessary. They also provide access to telemedicine visits via phone 24-hours a day, 7 days a week at no cost which makes getting necessary care quick and easy, even when work and family schedules make it difficult to go into a doctor’s office. Their app-based tools and live medical concierge are available 24/7 make finding care easy and convenient. As an added benefit to address employee concerns about prescription costs, Hooray Health offers a prescription discount card to ensure employees that they are receiving competitive prices for their medications.

Hooray Health removes financial and convenience barriers that prevent people from getting the care they need by making access to necessary care easy, convenient, and free for employees. This type of solution is particularly useful for employers with high deductible health plans where high out of pocket costs may deter employees and their families from seeking the necessary care that they need. While solutions like these remove barriers to care, they also save employers money by providing an affordable alternative to many of the care services needed by their members. Providing easy-to-use concierge-based access to a network of retail clinics, urgent care centers and telemedicine doctors ensures that employee health won’t neglect their health due to lack of money or lack of time. You can learn more by contacting them at info@hoorayhealthcare.com.

* * *

About BetaXAnalytics:

If you’re an employer who feels there’s got to be a better way to control health care costs, you’re on to something. And we can help. BetaXAnalytics partners with employers to use the power of their health data “for good” to improve the cost and quality of their health care. By combining PhD-level expertise with the latest technology, they help employers to become savvy health consumers, to save health dollars and to better target health interventions to keep employees well. For more insights on using data to drive healthcare, pharmacy and wellbeing decisions, follow BetaXAnalytics on Twitter @betaxanalytics, Facebook @bxanalytics and LinkedIn at BetaXAnalytics.

About Hooray Health:

Since its founding in 2017, Hooray Health has been committed to disrupting the health insurance industry by providing employers, individuals and their families with the assurance that their basic healthcare needs are covered. Here at Hooray Health, we believe that healthcare should be simple, honest, and affordable, that’s why whether you apply online or over the phone, the process is always simple, and acceptance is guaranteed. Partnered with over 2,300 urgent care and retail clinics, and a 24/7 medical concierge team, Hooray Health members know that no matter where they are or what time it is, their healthcare is there for them. Starting plans have a low monthly cost with no annual deductible, an affordable copay, and no surprise balance bills. Every day, Hooray Health is smashing the industry norms and bringing healthcare to all.