Why Budgeting For Health Care Is Near Impossible

DataHealthcare

The average millennial will spend between 1/2 and 2/3 of their lifetime earnings on healthcare. This jaw-dropping estimate, outlined in David Goldhill’s book Catastrophic Care: Why Everything We Think We Know about Health Care Is Wrong, is the perfect picture of how, for Americans, the new normal involves personally budgeting for healthcare expenses. Unfortunately it’s not an easy task to break healthcare costs down to what comes out of our personal pockets.

Divided equally among each person in the U.S., healthcare’s overall price tag averages out to over $10,000 per person each year—a whopping 18% of U.S. GDP. Since employers provide 48% of the healthcare coverage in the U.S. this burden has fallen heavily on their shoulders, and, as a consequence, they have shared this cost burden with employees. The growing popularity of high deductible health plans and copays means employees are sharing a larger portion of these healthcare costs, and as such, the average person needs to budget for these costs in their financial planning.

Healthcare Costs: What Employers Pay, What Employees Pay

The Milliman Medical Index estimates medical costs each year as they relate to employer and employee contributions. Based on data from 2018, healthcare for a family of 4 in the United States costs $28,166. Of this total cost, $15,788 comes from the employer, while the employee contributes on average $7,674, with an additional $4,704 paid by the employee for out of pocket for deductibles and copays.

Here’s a snapshot of the cost breakdown for employer-sponsored health insurance:

*2019 ACA Out of Pocket Maximums are $7,900/individual and $15,800/family.

These estimates are sound breakdowns based on large amounts of employer-sponsored plan data from Milliman. But do they truly inform how an individual can budget for their own healthcare expenses? Unfortunately the answer to this question is not so easy.

What Factors Influence Individual Health Spending

To understand how to budget for individual health expenses, we need to look at the levers that influence healthcare costs. And there are several factors which could cause individual health costs to largely vary. These factors are:

1. Age and Gender. Not surprisingly, actual health costs can vary greatly based on an individual’s age and gender. The figure below from the Peterson Kaiser Health System Tracker breaks down the American population by age, and then demonstrates each age group’s share of overall health spending.

2. Individual health status. Chronic illnesses such as diabetes and cancer have a marked impact on someone’s personal healthcare costs. The Centers for Medicare and Medicaid Services (CMS) report that 90% of the nation’s $3.3 trillion dollars in healthcare spending is for people with chronic and mental health conditions.

3. Geographic area. Differences in the costs of labor, rents and taxes in different geographic regions affect healthcare costs. Furthermore, areas of the country with more technological advances will have higher utilization rates of healthcare, further contributing to cost differences.

4. Provider variation. A frequently criticized hallmark of the healthcare industry is that provider costs can vary widely depending on where an individual goes to seek treatment. Furthermore, different payment methodologies, pre-negotiated payment rates and capitated rates can affect healthcare costs.

5. Insurance coverage. Richer health insurance plans tend to have higher utilization rates than budget options with less coverage. In addition, who is paying for the procedure can affect the ultimate cost. For example, what a provider is paid from Medicare (which, as demonstrated in the figure below, provides 14% of all coverage in the U.S.) and what they are paid under an employer-sponsored plan for the same exact procedure could be two different costs.

What Healthcare is Costing and What is Coming Out of Our Personal Pockets Are Two Completely Different Things

In short, the reason why budgeting for individual health costs is so challenging is because our system of how we pay for healthcare masks the true cost of healthcare. The subsidization in the health insurance market muddies the waters for anyone trying to budget for their own personal healthcare costs. And just in case this wasn’t confusing enough, the rules that govern this system which determine things like out of pocket maximums, in addition to insurance rates, change every year.

An individual trying to budget for their own expenses can use a best-guess of looking at their annual share of healthcare premiums and their average out of pocket costs each year. This assumes that their own past health expenses are the best way to predict future expenses. But even this approach is not perfect. Understanding how the $170/person cost of healthcare in 1960 made up only 5% of US GDP, compared to healthcare’s current share at 18% of GDP…the past might not always be the best predictor of the future where healthcare is concerned.

* * *

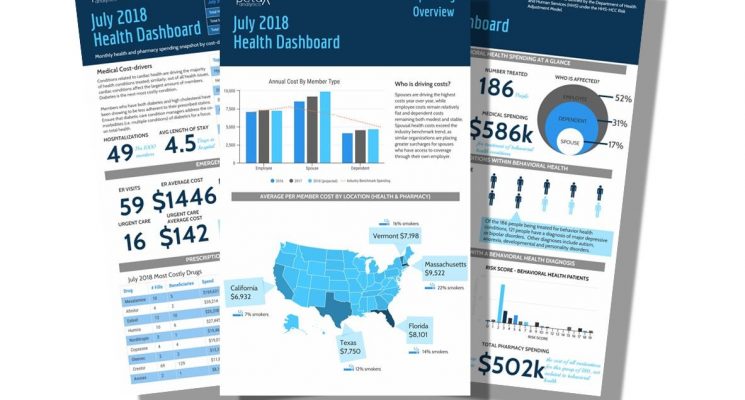

About BetaXAnalytics:

We combine data science with clinical, pharmacy and wellness expertise to guide employers and providers into a data deep-dive that is more comprehensive than any data platform on the market today. BetaXAnalytics uses the power of their health data “for good” to improve the cost and quality of health care. For more insights on using data to drive healthcare, pharmacy and wellbeing decisions, follow BetaXAnalytics on Twitter @betaxanalytics, Facebook @bxanalytics and LinkedIn at BetaXAnalytics.